Careers

Get Started

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Since The Beginning

We value teamwork, continuous improvement, integrity, accountability, and self-awareness.

Since our founding in 1997, Guardian Financial Life & Health has been dedicated to enhancing the financial health and security of middle-income families nationwide. Our core values remain unchanged, and our mission is more urgent than ever.

Accountability

To achieve success, it’s crucial to always prioritize the team’s best interests. We support our agents and their families with the same dedication we apply to protecting our clients.

Dedication

We are driven by our commitment to transforming the lives of both our clients and our agents. Our motivation comes from making a tangible impact, not just the “feeling” of doing good.

Fun

We love what we do! We get to work with amazing people, meet the needs of others, and grow our income without limits. What’s not to love?

Teamwork

The best results emerge from the collaboration of diverse experiences, backgrounds, and perspectives.

Growth

To achieve our very best, we focus on enhancing our capacity in every area. This includes expanding our product offerings and training for our team, as well as deepening our compassion and understanding for our clients.

Integrity

Our character is defined by our consistent ability to adapt to and meet the demands of an ever-changing financial landscape.

Tools For Growth

We work hard and value our work life balance. Check out our benefits below.

Tools For Success

Compensation

Know Your Worth

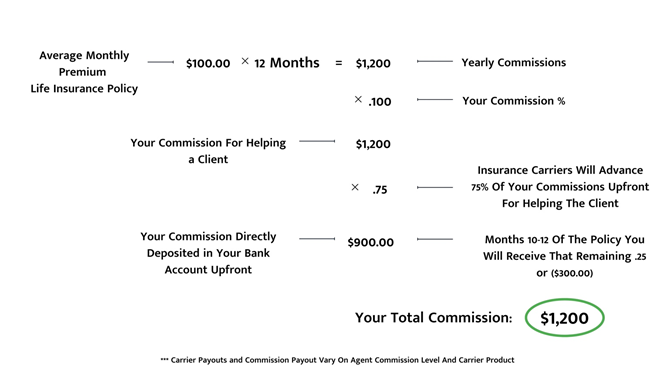

We believe that quality work deserves recognition and reward. We also hold that anything worth having in life must be earned. Building a client’s trust and securing their business is a skill developed through top-notch training and experience. Those who commit to our training and embrace our system are rewarded with an industry-leading commission structure and an aggressive promotion schedule. To the right, you’ll find an example of the commission an advisor earns on an average mortgage protection sale.

Quality Leads

Cold calling is not an efficient way to build a business quickly in financial services. That’s why we don’t require our advisors to find clients or approach family and friends to grow their business. Instead, we partner with top-rated companies that provide us with clients who are actively seeking the services we offer. Each client has taken the time to fill out either a physical or online form, ensuring they are genuinely interested in the assistance we provide.

Training

Practice Makes Perfect

Proper training and guidance are crucial for success in any industry. We take pride in offering quality content that helps individuals with little to no financial advisor experience build a long and fulfilling career. With our resources, knowledge, and training, anyone can learn the business and start increasing their earning potential quickly!

Training starts with obtaining your license. We offer online courses through our partners, allowing you to learn at your own pace. Our corporate sponsors provide various tools to suit any learning style, including video breakdowns, a glossary of terms, and more.

Once licensed, new agent training includes online videos, live Zoom courses, and one-on-one walkthroughs. We even have a dedicated website, “The University,” which houses extensive content on every carrier and product we offer. And to ensure you’re supported every step of the way, new advisors are paired with a mentor to help navigate the start of their career. We are committed to using every resource available to ensure the success of our new advisors.

Leads Types

Quality Leads

We are dedicated to ensuring a fulfilling and successful career for our advisors. That’s why we connect them with clients who are actively seeking our services right now. Cold calling is not an effective way to quickly build a business in financial services.

Instead of having our advisors hunt for clients or reach out to family and friends, we partner with top-rated companies that provide us with leads from clients who have expressed interest in our services. Each client has taken the time to fill out either a physical or online form, ensuring they are genuinely looking for the assistance we offer.

Mentorship

Experience is Key

Mentoring is crucial for success in the financial services industry. Our CEO, Adam Burge, achieved his success thanks to the leadership and guidance of his mentors. We firmly believe in the power of mentorship and growth, and we see it as more important than ever in our rapidly evolving industry.

To help our advisors win big, we provide top-notch mentorship from experienced leaders. Adam’s goal is to offer you the same opportunities he had and support you in building a long and fulfilling career.

Growth Mentality

You’ll never receive worthwhile returns without investment. We approach each new advisor with a growth mindset, focusing on developing the whole person. This holistic approach, which includes time, training, tools, and more, is designed to enhance both their personal and professional growth.

When we find the right candidate, we are committed to investing in them to jumpstart their career. We ensure they have all the necessary resources and tools to not only reach but exceed their goals.

Frequently Asked Questions

We understand that researching a new industry involves many considerations. Below are the most common questions we receive from prospective applicants:

Whether you have other obligations or are new to the industry, our goal remains the same: to help both our clients and our advisors succeed. If you can only commit to part-time initially, we have the structure in place to support you. Our focus is on your success, no matter the time commitment.

No, we don’t engage in cold calling or ask you to contact your family and friends. Our goal is for you to have a fulfilling and successful career. We place our advisors in front of clients who are actively seeking our services. Each client has taken the time to fill out either a physical or online form, ensuring they are genuinely interested.

Getting started is a swift process for those who are ready to move quickly. The first step is to obtain a Life and Health Insurance license, which is required in every state to discuss financial products with clients. We have corporate sponsorships that can help cover some of the start-up costs for acquiring the license. Once you pass your state exam, we’ll get you appointed with several of our top carriers and begin the onboarding process.

Yes, our advisors have always worked remotely. While some advisors may have brick-and-mortar locations for collaboration and training, there are no mandatory office hours. Working remotely provides our advisors with the freedom and flexibility to create a work-life balance that suits their needs.

We partner with over 40 insurance carriers, including some of the largest and most reputable companies in the industry, such as Mutual of Omaha, Transamerica, AIG, and Blue Cross/Blue Shield. These carriers trust us to represent them because we conduct our business with integrity and prioritize the needs of our clients.

Absolutely. Financial literacy and security are more critical today than ever before. Recent events have highlighted the importance of having a smart financial plan. Additionally, the industry is experiencing a significant wealth transfer in America, with many families seeking advisors to help them plan for transferring assets to the next generation. There is unprecedented growth potential for advisors in this dynamic environment!